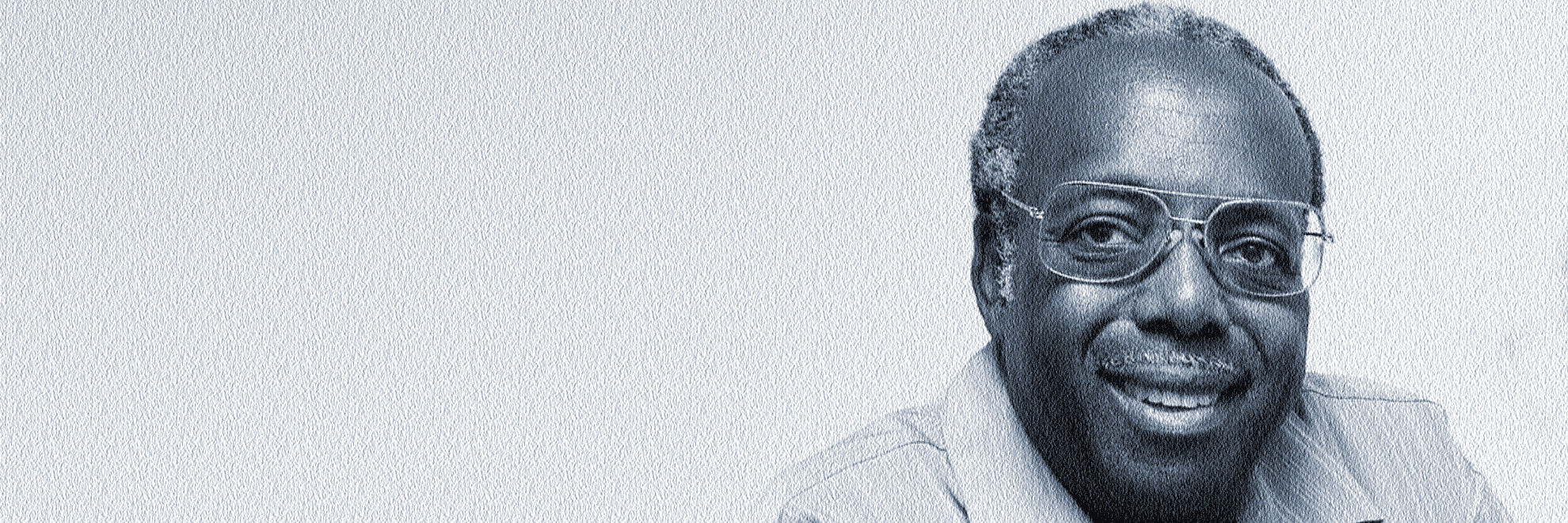

Anthony’s Story: Planning for Long-Term Care Over Age 65

Date posted: June 14, 2016Anthony’s health was deteriorating, and he was finding it harder to live independently. His income put long-term care insurance outside of his budget. Anthony’s situation is not unusual. The federal government reports that about 70% of people over age 65 will require at least some type of long-term care services, but that only about 10% have this type of insurance coverage.

Anthony’s children, Louise and David, talked with an elder law attorney about what they could do to prepare for a future that would likely include their father living in a nursing home. The attorney explained that many people (wrongly) believe that Medicare will pay for long-term care. She also stated that most Americans underestimate their likelihood of needing this kind of care.

The attorney informed Louise and David that their father could qualify for Medicaid and access long-term care. She encouraged the family to consider funding a special needs pooled trust with Anthony’s remaining funds. By doing this, Anthony’s resources would be preserved, he could qualify for Medicaid and therefore long-term care, and he could use the funds in trust to maintain the quality of his life. The attorney referred the family to PLAN of MA and RI.

A PLAN social worker would meet with Anthony and his adult children to develop a blueprint for disbursing the funds; movies and books, non-medical therapies, a companion, etc. This arrangement gave Anthony’s children peace of mind. They felt comfort knowing that PLAN, as trustee and fiduciary, had the experience and staff to assist with the prudent management of their dad’s funds, protection of their dad’s benefits, and compassionate care.